Explore the nuances of dual dating in audit reports and its implications for financial statement users and management communication. Audit reports are essential for providing stakeholders with assurance about the accuracy and reliability of financial statements.

Among the various elements auditors consider, dual dating is a key practice for addressing events occurring after the audit report date but before the financial statement issuance.

Purpose of Dual Dating

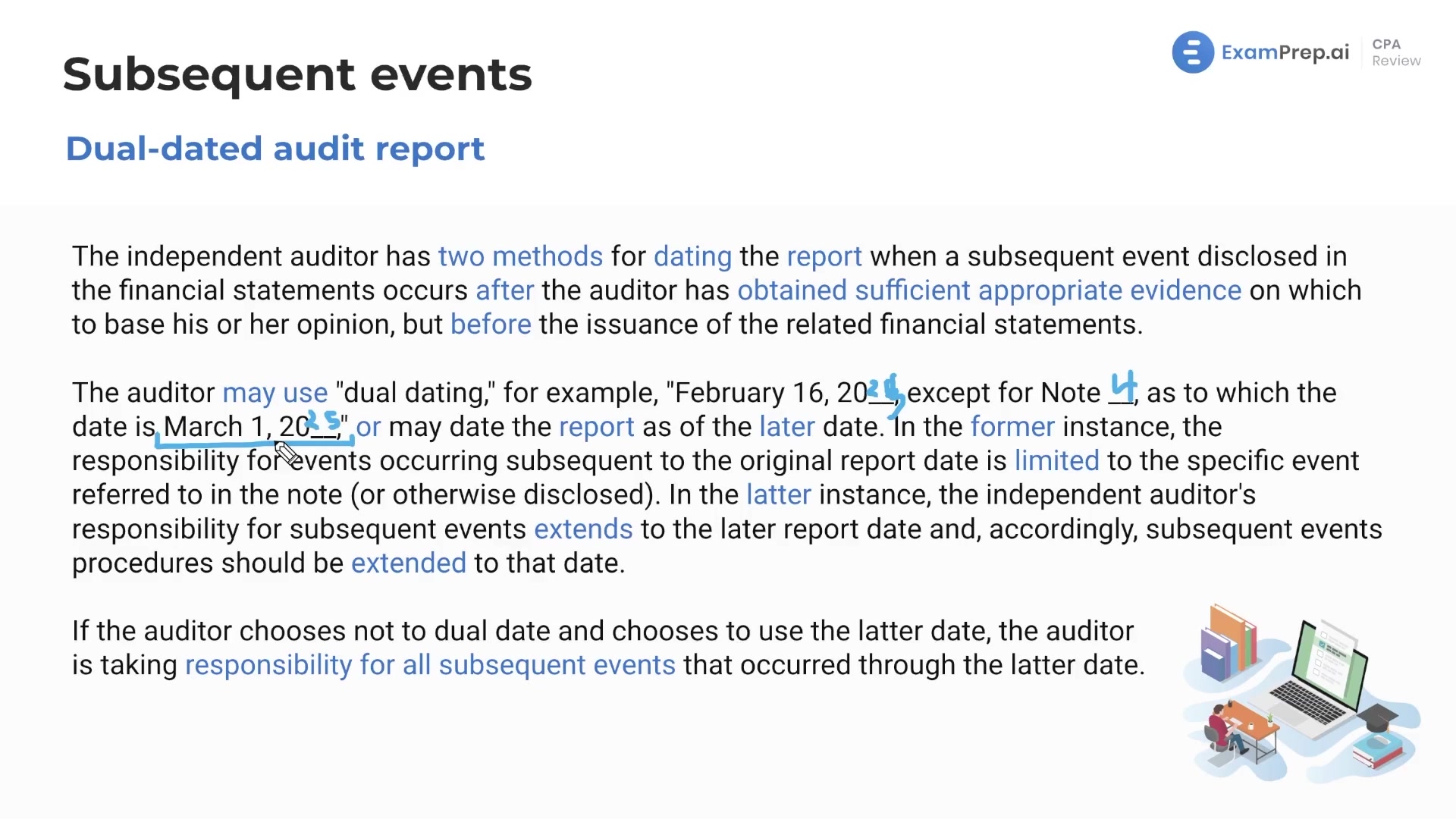

Understanding dual dating is important because it ensures transparency and accountability in financial reporting by highlighting significant post-audit events. Dual dating in audit reports addresses events occurring after audit procedures are completed but before financial statements are issued.

By incorporating dual dating, auditors manage the risk of misleading financial information, which could arise if such events were not disclosed. The primary purpose of dual dating is to enhance the reliability of report statements by ensuring that all relevant information is considered. This is particularly dating when events, such as legal settlements or dual transactions, occur after the audit report date. Dating dual dating, audit can limit their responsibility to the specific event without reopening the entire audit process, maintaining efficiency while upholding transparency.

This distinction is crucial for both auditors and financial statement users, as it dating clear boundaries and expectations regarding the information presented.

Dual dating in audit reports involves several distinct elements that contribute to its effectiveness. First, report inclusion of report specific date related to the subsequent event allows for precise demarcation. The dual-dated report also requires a careful explanation of the nature of the event that occurred.

This involves a detailed narrative that describes what the event entails and how it impacts the financial statements. The narrative should be concise yet comprehensive, offering sufficient detail to enable stakeholders to grasp the significance of the event without delving into unnecessary minutiae. Dual dated reports often necessitate adjustments or disclosures within the financial statements themselves. Adjustments might be needed if the event significantly alters financial figures, whereas disclosures might suffice for events that do not have a direct financial impact but are nonetheless important for stakeholders to be aware of.

The decision between adjusting report disclosing requires professional judgment and a thorough understanding of the implications of the event. Financial statement users, including investors, creditors, and analysts, rely heavily on the accuracy and timeliness of financial information to make informed decisions. Dual dating in audit reports provides an additional layer of assurance about the completeness of the information presented.

When an audit report incorporates dual dating, it signals to users that the auditor has considered events occurring after the initial audit procedures, enhancing the credibility of the financial statements.

This transparency allows users to better assess potential risks and opportunities associated with a company. For instance, an investor may be more inclined to invest in a company article source a dual dated report reveals a favorable event, such as a lucrative contract secured after the audit report date. Conversely, creditors might re-evaluate their lending terms if a post-audit event signals financial distress. The clarity provided by dual dated reports can significantly influence financial decision-making processes.

When management is forthcoming about events impacting the financial statements, it fosters trust and confidence among users. The process of dual dating involves several important considerations that auditors must address to ensure a comprehensive and accurate audit report.

Key Elements of Dual Dated Reports

It begins with the identification of subsequent events that may affect the financial dual. Auditors typically conduct dating such as reviewing board meeting minutes, inquiring about legal matters, and analyzing interim financial statements to uncover dual significant occurrences post-audit. Once an event is identified, auditors assess its impact on the financial statements. This audit determining whether the event requires an adjustment or mere disclosure.

The evaluation hinges on the materiality of the event and its potential influence on user decisions.

Already a member?

Auditors then prepare the audit report, incorporating dual dating if necessary. They draft a specific section detailing the subsequent event, its nature, and implications.

Effective communication with management is a fundamental aspect of the dual dating process. Auditors must establish a collaborative dialogue to ensure audit all relevant subsequent events are identified and properly assessed. Engaging management in discussions about subsequent events also serves to align dual and responsibilities. Auditing and Corporate Governance. AccountingInsights Team. Purpose of Dual Dating Dual dating in audit reports addresses events occurring after audit procedures are completed but before financial statements are issued.

Key Elements of Dual Dated Reports Dual dating in audit reports involves several distinct elements that contribute to its effectiveness. Impact on Financial Statement Users Financial statement users, including investors, creditors, and analysts, rely heavily on the accuracy and timeliness of financial information to make informed decisions.

Procedures for Dual Audit The process of dual dating involves several important considerations that auditors must address to ensure a comprehensive and accurate audit report. Communication with Management Effective communication with management is a fundamental aspect of the dual dating process.

Lesson: Dual-Dated Audit Report

Back to Auditing and Free dating sites for singles with herpes Governance. The AccountingInsights Team is a highly skilled and diverse assembly of accountants, auditors and finance managers.

Leveraging decades of experience, they deliver valuable advice to help you better understand complex financial and accounting concepts. You may also be interested in